Bank of England base rate

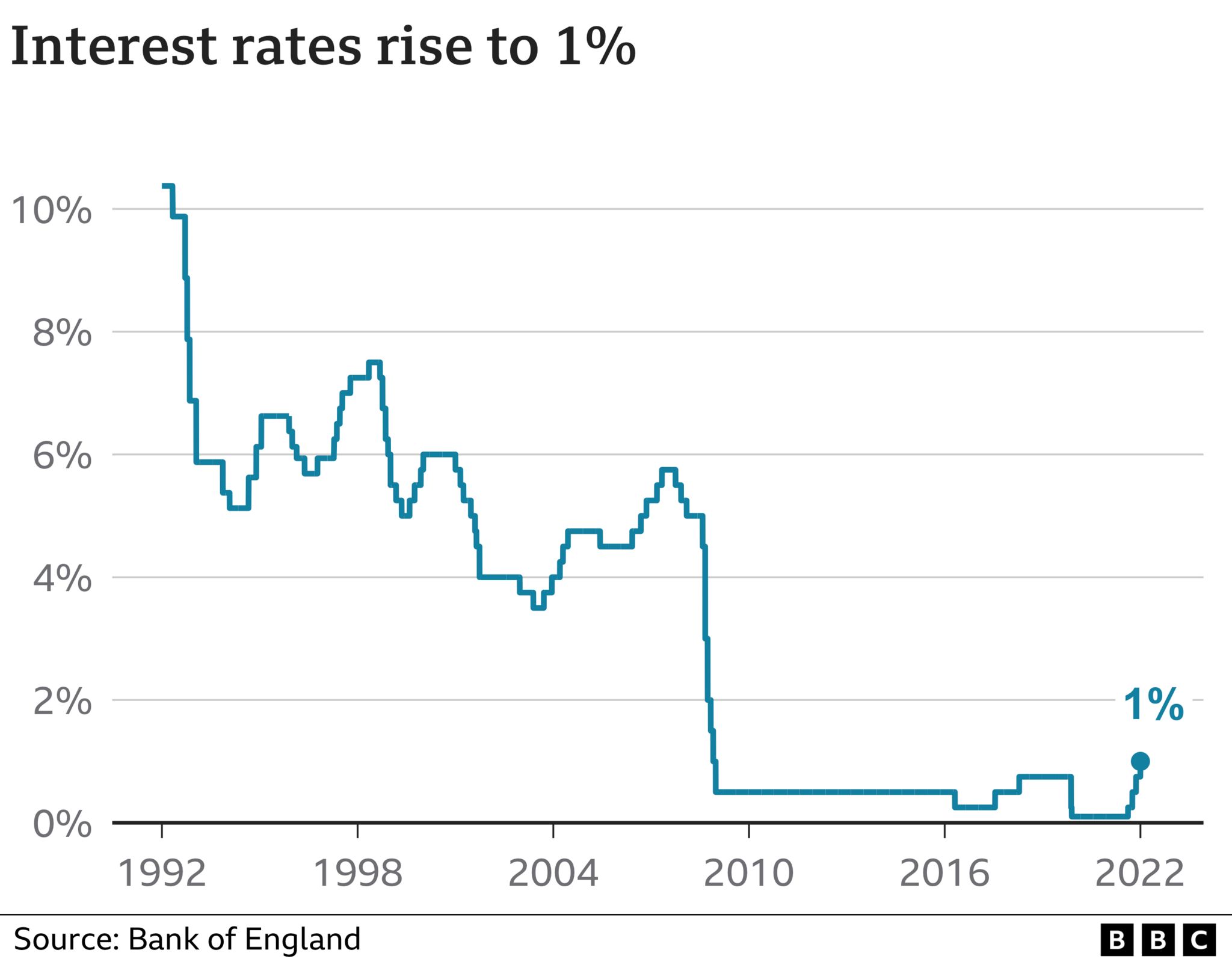

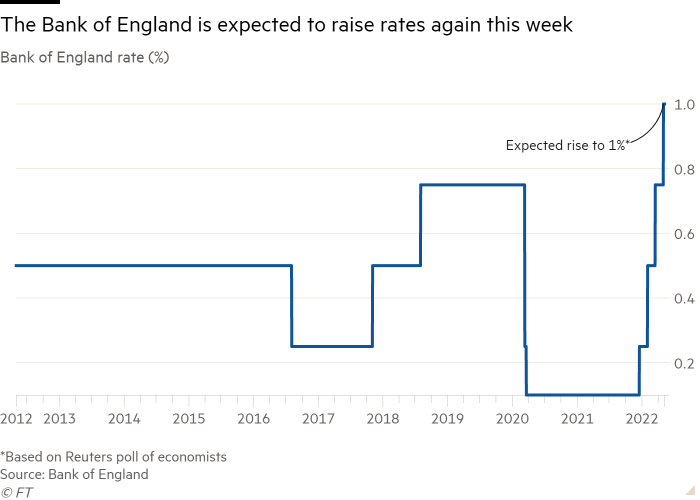

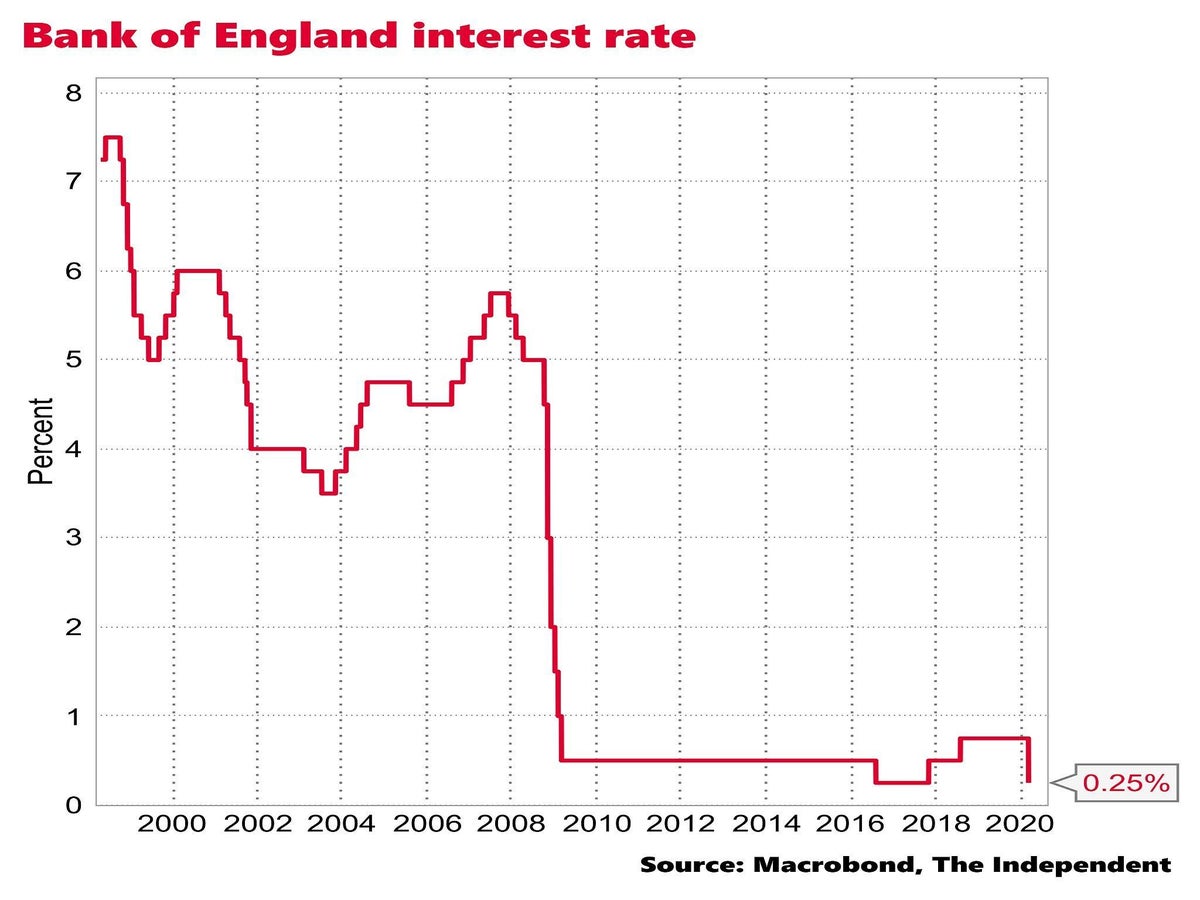

It was raised to 025 in December 2021 and again to 05 in February 2022. The chart below shows how the base rate has.

Boe Official Bank Rate British Central Bank S Current And Historic Interest Rates

It is predicted the Bank of England will raise the base of interest to 1 today - a level not seen since February 2009 - from its current.

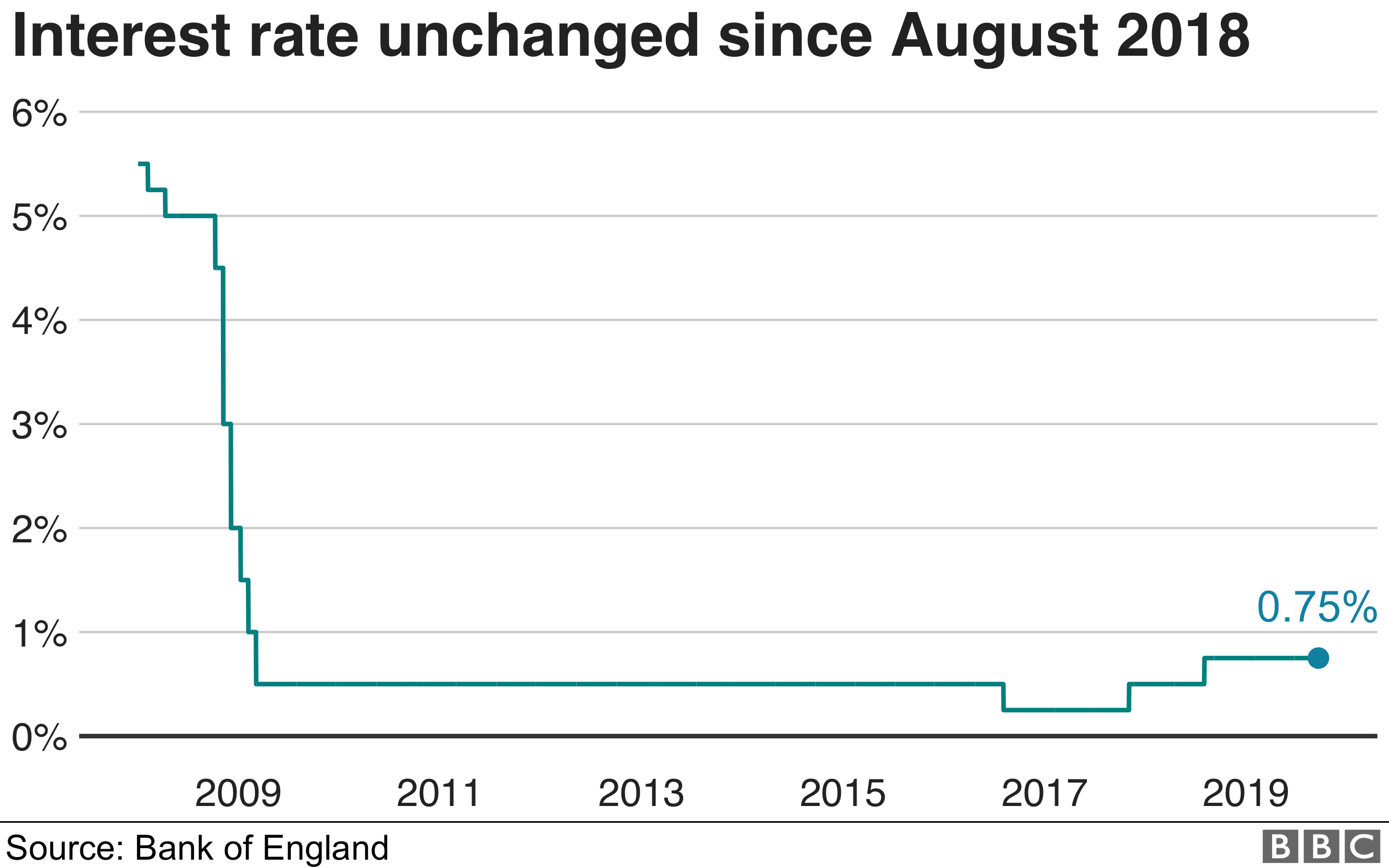

. Bank of England expected to raise base rate to highest level in 13 years as walks very fine line between cooling inflation and avoiding recession. The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020. On 2 August 2018 the Bank of England base rate was increased to 075 but then cut to 025 on 11 March 2020 and shortly thereafter to an all-time low of 01 on 19 March as emergency measures during the COVID-19 pandemic.

The aim of the base rate reduction was to help control the economic impact of coronavirus on the UK economy. When the base rate is lowered banks. It is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day.

This base rate is also referred to as the bank rate or Bank of England base. Interest is a fee you pay for borrowing money and is what banks pay you for. The base rate is the interest rate that the Bank of England charges commercial banks for loans and until now stood at 075.

The Bank of England reviews the base rate 8 times a year. The latest as the Bank of England increases the. Bank of England hikes interest rates to 1 as millions of businesses and households battle against rampaging inflation.

Lower rates encourage people to spend more but this can lead to inflation an increase to living costs as goods become more expensive. 47 rows The Bank of England base rate is the UKs most influential interest rate and its official. It is the base rate of interest for the UK economy and has a strong impact on the short and long-term interest rates charged by commercial banks.

Bank of England top brass have hiked interest rates from 075 to 1. Continue reading to find out more about how this could affect you. The Bank of England has increased base rates to 075 from 05 after the Monetary Policy Committee MPC voted in favour of a rise.

The Bank of England BoE base rate is often called the interest rate or Bank Rate and sets the level of interest all other banks charge. The current Bank of England base rate is 075. The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate.

The Bank of England has raised the base rate of interest to 1 - the fourth consecutive increase as it continues to move against surging inflation - despite issuing a warning about a recession ahead. The Bank of England Base Rate BOEBR also known as the official bank rate is the rate of interest charged by the BoE to commercial banks for overnight loans. The official bank rate has existed in various forms since 1694 and has ranged from 01 to 17.

The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. Zoe Tidman 5 May 2022 0859. On 17 March 2022 the Bank of England announced a change in the Bank of England Base Rate from 05 to 075.

The change means higher mortgage payments for more than two million. The bank reduced the base rate from 075 to 025 1 week earlier on 11 March 2020. Bank of England is expected to hike interest rates AGAIN today to 13-year high of 1 in another hammer blow for struggling families.

Bank of England issues UK recession warning and says inflation could top 10 this year. The base rate was increased from 025 to 050 on 3 February 2022 to try and control inflation. It was increased by 025 percentage points on 17 March 2022 the third rise recorded since December 2021.

Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability. This sets the Bank of England base rate which is the interest rate at which banks borrow. The base rate was previously reduced to 01 on 19 March 2020 to help control the economic shock of coronavirus.

If the Bank of England does raise the base rate to one percent this will be the fourth consecutive hike since the financial institution started raising borrowing costs in December 2020. The Bank of England base rate is currently 075. Paper 20 and 50 note withdrawal.

This page shows the current and historic values of. Decisions regarding the level of the interest rate are made by the monetary policy committee MPC. Interest rates live.

Higher rates can have the opposite effect. The Bank of England BoE base rate which will be reviewed on Thursday May 5 impacts high street bank interest rates. The current Bank of England base rate is 075.

The Bank of England can change the base rate as a means of influencing the UK economy. The UKs interest rates are set by the Monetary Policy Committee MPC of the Bank of England BoE. The Bank of England is poised to raise interest rates to the highest level since the recession caused by the 2008 financial crisis despite mounting concern that the economy is weakening amid the.

The Bank of Englands Monetary Policy Committee MPC voted to increase the rate in response to inflation hitting 55 well above its target of 2.

Negative Rates Explained Should Uk Investors Prepare Institutioneel Schroders

How The Bank Of England Set Interest Rates Economics Help

Halifax Apologises After Interest Rate Email Blunder Bbc News

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent

Bank Of England Forecasts Low Interest Rates For Longer Bbc News